CIVIL SOCIETY SILENCED, PARLIAMENT APPROVES TAX ON MOBILE MONEY, SOCIAL MEDIA

www.mknewslink.com

In Kampala

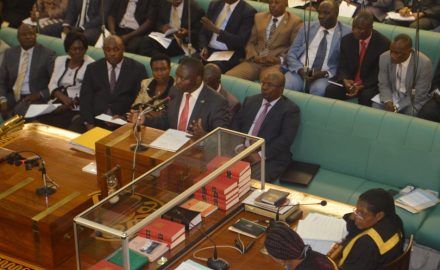

Just a day after civil society in western Uganda held a protest in Bushenyi, Parliament has passed the Excise Duty (Amendment) Bill, 2018 with amendments approving government proposed tax on Mobile Money transactions, Social Media as well as reducing the tax on Soft Drinks.

Yesterday, civil society activists led by Apollo Kakonge of West Ankole Civil Society Forum, held a press conference, directly opposing tax on Mobile Money. Prior to that, the Managing Director mknewslink.com had petitioned the Parliament opposing the imposition of social media tax.

The parliamentary decision might be deemed a slap in the face of weeks of vigorous pushing by members of public with support from civil society, for government to find alternatives sources of revenue rather than mobile money.

There has been fear from experts that this tax was likely to undo a lot of progress made so far in the country, regarding financial inclusion.

The tax bill was passed after a heated debate that followed a report by the Parliamentary Committee of Finance, which recommended that Parliament passes the proposals tabled by government through the Ministry of Finance.

According to the approved bill, the social media tax, which will be levied on every mobile phone subscriber in Uganda who uses platforms such as WhatsApp, Twitter and Facebook, will amount to Shs200 per day.

Government argued that at the moment, voice and messaging traffic has migrated from conventional voice calls and messaging to voice over the internet and online messaging, through applications like WhatsApp, Skype, yet these services do not attract excise duty, unlike voice calls that attract VAT and excise duty.

The Finance Committee supported the proposal stating that it is unfair and inequitable for consumers who buy airtime and use it to make voice calls compared to those who buy internet data and make voice calls.

The house also approved the proposals by government to have 1% tax slapped on the value of Mobile Money transactions were government intends to collect Shs115billion.

The Committee justified their decision noting that the use of mobile money is an efficiency gain and should be taxed, adding that money has migrated from the traditional payment systems like banks to the digital platforms.

The Leader of Opposition, Winfred Kiiza wondered why Government isn’t slapping more tax on items like cigarettes, beer and alcohol in sachets to make youths more productive, adding that the tax on mobile money is unfair.

State Minister for Planning, David Bahati lashed out at opponents of the bill, saying that tax is a contribution, not a punishment and that the appetite for those demanding good services must be backed by measures to support them.

Meanwhile, the Committee rejected the proposal to impose Excise duty on soft drinks arguing that the current tax is already the highest in the region and further taxation is bound to encourage smuggling of soft drinks from the neighboring countries.

Source: www.mknewslink.com a greater western Uganda news website

Email: wmuhwezi75@gmail.com

Tel: +256702680106

Views Today : 67

Views Today : 67 Views Yesterday : 411

Views Yesterday : 411 Views Last 7 days : 3261

Views Last 7 days : 3261 Views This Month : 10316

Views This Month : 10316 Total views : 1447920

Total views : 1447920 Who's Online : 1

Who's Online : 1 Your IP Address : 3.17.175.167

Your IP Address : 3.17.175.167