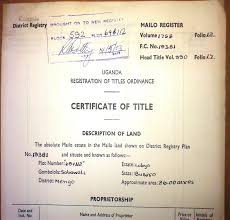

This product is designed to help all KYAPS members to acquire land titles for their land both in villages and urban areas. The product provides both short term and medium funding from one month up to a maximum of 12 months.

This product is designed to help all KYAPS members to acquire land titles for their land both in villages and urban areas. The product provides both short term and medium funding from one month up to a maximum of 12 months.

The loan is to be provided to those members who have optimal scale to generate margins that meet the cost of the loan.

Market research

A team of managers conducted a market research from different financial institutions like Centenary Bank, Pride microfinance, Post bank, EBO SACCO, and Rwanyamahembe SACCO. The following were the findings.

KYAPS shall have three categories of clients whereby;

- Some members will need titles without outstanding loan.

- Others will need both i.e loan and land title.

- Other members will need to pay cash so that KYAPS helps them to get land tittles.

Clients in town branches taking loans above ten million should be required to produce land titles whereas those in villages requesting for twenty million above must produce land titles.

The costs for preparing a land title vary as here under:

- Location, For example preparing a land title in town is more costly than in a village.

- Size of the land due to mark stones used.

- Shape of the land.

For clients who need loans from any loan product that needs a land title, the cost for the title is added on the loan and a register is maintained for all title applicants at the branch.

The minimum and maximum amount for the title is between 1,500,000= to 3,500,000= respectively.

On appraisal a particular credit officer goes with the surveyor. After appraisal, the surveyor prepares a reconnaissance report that shows the coordinates and size of the place, Values the land basing on size and market values. In his report, he includes the cost of the title.

Search letters for clients with titles must be obtained. Also loans to be obtained by clients with land titles, valuation report relying on government valuer is always made on cost of borrower. Reconnaissance report involves a commitment letter that a customer signs and it is kind of consent agreement for the title. Reconnaissance report contains a specific period to the completion of land title preparation.

At the time of disbursement, 40% is given to the surveyor and the balance for the title is with held until the title is produced. The client meets costs of assisting the surveyor in tracing the neighbors to sign forms. Transportation of forms and dealings with committee of lands is met by the surveyor.

Follow up and overseeing the whole process is the duty of the Credit Manager. For purposes of efficiency, A Credit Officers will be selected at each Branch for land titles loan product for better reporting and progress.

It is the duty of the bank to make a follow up on the titles spearheaded by credit manager. The surveyor has a duty to show estimates of time and costs taken on various stages of title process.

- At deed plan, 80% is paid to the surveyor.

- At offer stage, 90% is paid.

- Delivery of title, 100% is paid.

Minimum period of 3 months for the title to be processed.

For Transfers, and mutation, The Maximum period to get the title is 8 months.

Client fills the loan agreement plus the reconnaissance agreements which is very specific. KYAAPA loan will be prepared manually by keeping registers at the Branch for reporting purposes.

Objective.

- To provide true ownership of the land

- To add value in members land

- To enable KYAPS members to have genuine securities

- To eliminate land conflicts

Benefits.

- The product gives full ownership of the land

- The loan is calculated on reducing balance

- Low interest rate of 2%-2.5% per month

- Quick and easy to access

- The loan has an insurance cover

- Portfolio growth on the side of KYAPS

- Member retention

- Savings maximization

Eligibility for the loan.

- Applicant should be 18years and above

- Original documents of the ownership of the land

- Photocopy of the national identity card

- Share to loan ratio of 1:7 is considered

- Applicant should have KYAPSAVE account

- At least two guarantors are required at the time of application.

Marketing

Marketing KYAAPA loan product is very vital to ensure its success. In this phase the Marketing team will conduct several trainings to champion the product and this involves educating all staff members, BOD members and clients on how the product works.

The marketing and sales officer must develop marketing literature such as brochures, banners, fliers and presentations that effectively communicate the products features and benefits, and formulating a cohesive media strategy that will inform the client about KYAAPA loan product.

Product Launch.

Finally, KYAPS with the help of marketing team will organize one day when the product will be officially launched. This new product will be launched with a lot of sensitization of members, even involving media house before launching this product, all staff members must be well conversant with product so as to be able to sell what they know.

Product and Profitability Review / analysis

This is the final stage for KYAAPA loan. The product will be reviewed at set periodic intervals to assess various parameters like product sales versus projections, unexpected challenges, risk management and what has the product contributed to the institution in terms of profit making depending on the outcome of such periodic reviews. This will be championed by the marketing team .

PRODUCT DEVELOPMENT

| 8ps | Features |

| Brand Name | KYAAPA LOAN PRODUCT |

| Target market | The target market is the medium and high income earners who are engaged in agriculture and daily business activities. |

| Product design | |

| Loan eligibility

|

Must be a registered member of KYAPS and shareholder.

Must have active account Must be a citizen by birth or nationalization of Uganda. Age between 18 years and 70 years and of sound mind. Must be a credit worthy member. Must fill and submit KYAPS Loan application form certified by Chairperson Local Council 1 (LC1) with competent guarantors. Must have constant cash flows passing from the account Have a general use and permanent identity document with a photo, full name, address and number. Must have at least one year of residence in the same community. Must be of a good moral character. Provide evidence of profitable productive activity / business which must generate daily income. Must have guarantors who are not defaulters. The applicant must have the original document of the ownership of the land. |

| Price | |

| Minimum loan | UGX 1.500.000= |

| Maximum loan amount | UGX 3,500,000= |

| Loan period

|

Maximum loan period: 12 months

Minimum loan period : One month |

| Amount to earn interest rate | The amount approved as KYAAPA loan earns interest rate of 2-2.5% per month |

| Payment Mode

|

The payments are made monthly, quarterly and bi-annually depending on the cash flows of the client. |

| Promotion | |

|

|

Direct marketing by KYAPS staff.

Encourage word of mouth using the staff and client through referrals Sensitization meetings with clients especially at the time of disbursement. Advertise in the press ,radio and TV Use promotional materials: Brochures Notes in the banking hall, car bumper, stickers, calendars. Events sponsorships |

| Place | |

|

|

Offered at all KYAPS Branches |

| Positioning | |

| Slogan/Tagline | KYAAPA Loan

(get full ownership of your land ) |

| Physical evidence | |

|

|

Loan application form

Consistent use of corporate colours Kyaps Branches |

| People | |

|

|

Branch managers, knowledgeable and competent staff, polite friendly and supportive staff.

Professional outlook- Decent dress code, Name tags/ identity cards. |

| Process | |

|

|

A Member fills loan application form requesting for the loan.

One day to five days are enough to process the loan.

|

Views Today : 361

Views Today : 361 Views Yesterday : 269

Views Yesterday : 269 Views Last 7 days : 3026

Views Last 7 days : 3026 Views This Month : 11630

Views This Month : 11630 Total views : 1449234

Total views : 1449234 Who's Online : 2

Who's Online : 2 Your IP Address : 3.144.252.243

Your IP Address : 3.144.252.243